American Express has been offering some amazing discounts lately. Generally, I focus on travel-related offers but today I want to highlight how credit cards (and offers) can save you so much money with just a bit of creativity.

AMEX OFFERS

There is no doubt the pandemic has affected businesses across the board and many companies are developing creative ways to increase revenue. This has created several unique opportunities for individuals that possess credit cards to save a lot of of money (like saving 40% off a plane ticket, racking up points for shopping at Amazon, or just simply eating.

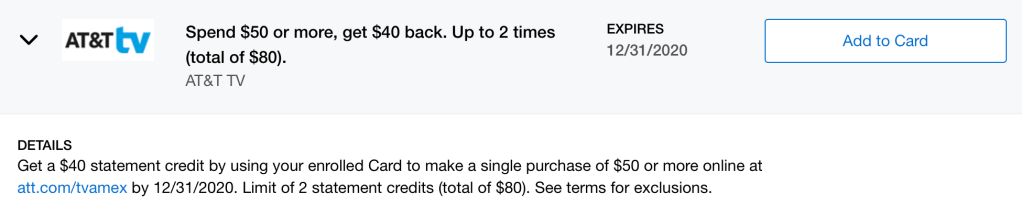

Over the past few weeks, Amex has continued to drop even more great offers. For example, there’s currently a new targeted Amex Offer to receive earn a $40 statement credit by using your enrolled Card to make a single purchase of $50 or more online at att.com/tvamex. The offer expires on 31 December 2020 and can be completed up to 2 times.

Again, this offer isn’t necessarily travel-related. In fact, I think it is a bit niche. But consider this…Amex is awarding up to 80% off and with a bit of creativity (and an actual need for the offer), this is instantly money back in your pocket.

For example, let’s say your AT&T bill is $10 per month. Why not pre-pay your bill before the expiration date of 12/31/20 and make two separate payments of $50?

After the credits are applied (which should take less than 72 hours), you will only owe $20 total to Amex and your AT&T bill is paid for the next 10 months!

Consider the implications if you’re in two-player mode (aka P1 & P2). For example, I have the offer on my Amex card and my wife has it on her own personal card also. Use both offers on both cards twice. I trust AT&T will gladly take my money ahead of time and apply the credit to my account. In this case, my AT&T bill will be paid off for nearly two years.

Interestingly, if you’ve been following my posts recently, you may be keenly aware of cash back portals. One site that I use frequently use to compare cash back options is cashbackmonitor.com.

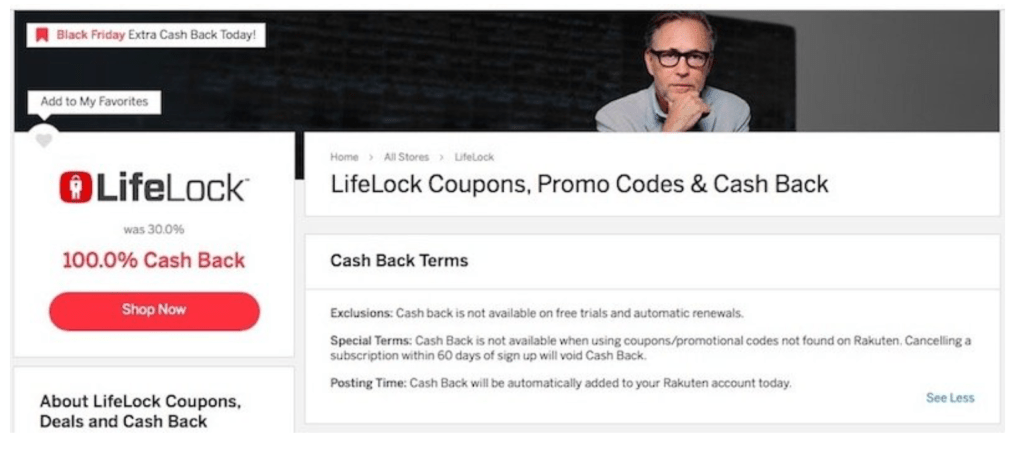

Before I make any online purchase, it’s worth taking a minute to check if there is a stacking opportunity, and you never know what will be offered. Did you miss the opportunity to earn 100% cash back (or 100x the Amex points) through Rakuten for Lifelock on Black Friday?

The craziest part of the Lifelock promotion is I’ve seen it as high as 125% cash back! Yes, they paid you to keep your information safe.

I have mentioned this in countless posts but I’ve saved more than $1000 through Amex offers on one card and I’ve only had one specific card for a few months. Read about it HERE!

HOW DO I SEE MY ‘AMEX OFFERS?’

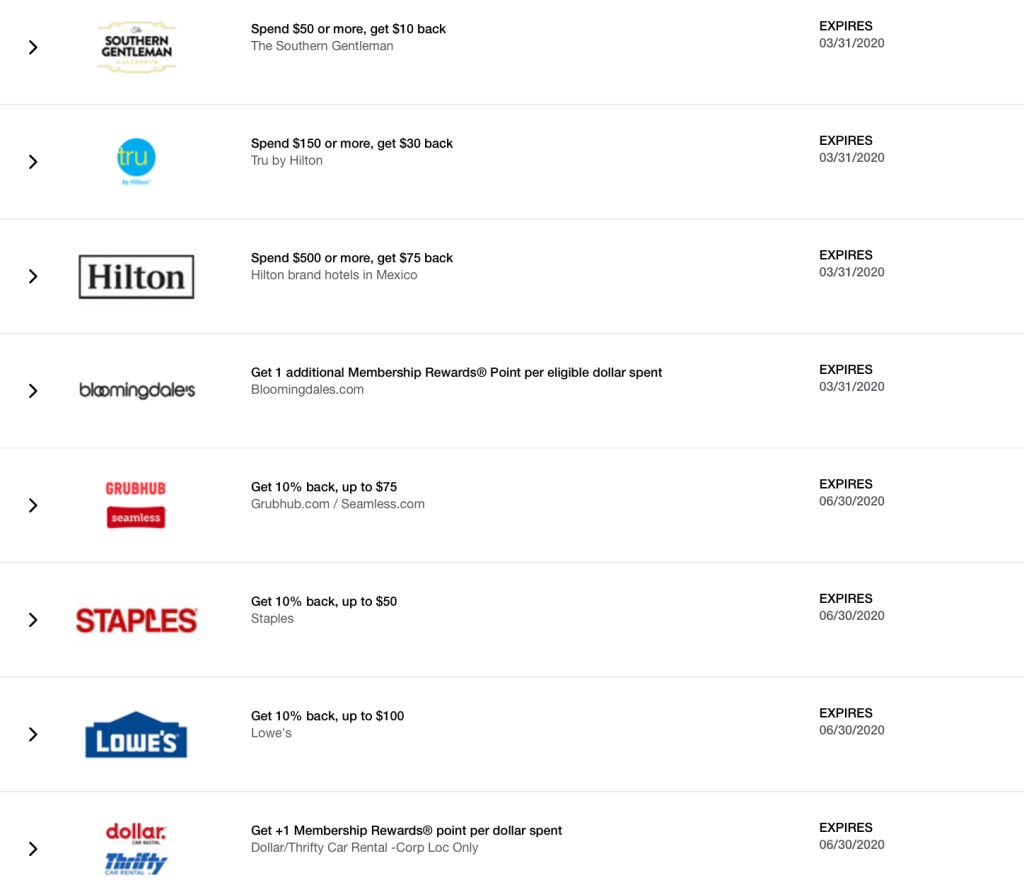

To view your Amex Offers, login to your Amex account and scroll to the bottom of your account summary page where you’ll see a list of eligible offers for that specific card. It should look like this…

FINAL STAMP

As always, there should be no pressure to take advantage of every offer. Generating points on purchases that you were going to make anyway is great but paying late fees or interest on those offers is nonsense and negates the value!

Pro-Tip: I would recommend taking a few minutes and browsing through your Amex offers just to see what is available and adding any offers that you may take advantage of (even if you ultimately don’t use it.). American express has started this “unique” trend where they only let so many people add the offer to their card and once it hits that limit, it disappears from your account if you haven’t loaded it.

And don’t forget, you can use THIS TRICK if you want to see more Amex offers.

Just to be clear, the objective is not to spend money, but rather save money for purchases you had planned to make anyway.

Are creative juices flowing? If you could design an Amex offer, where would it apply?

Let’s get straight to the point…some of the links on this site pay 1TattedPassport a referral bonus for anyone that is approved. For our complete advertising policy and details about our partners, please click HERE. Although using the links are completely optional, we are eternally grateful when you do.

I needed a new pair of glasses and my Amex offered at least 4 options for statement credits. Found a pair that I liked and searched for the website offering that frame for the lowest price . After purchasing, right away I received a $20 Amex statement credit. I got a new pair of perception Ray Bans $102! Early Birthday present for me. I’ve been wanting to get new glasses for years.

If I could design a Amex offer it would be with Grocery Stores, Gas (no app needed) Verizon phone bills, Apple store, all the essentials lol. Unlimited statement credits 🙂 My Amex Delta Gold doesn’t give me that great of offers.

LikeLiked by 2 people

@J.O. An early bday present, a discount, and a purchase in the making for years…I consider that a nice win.

I’ll keep my eyes open but would recommend browsing the offers weekly. I’ve seen offers for discounts on grocery purchases (which you could stack with the grocery bonus category like Amex Gold), offers on gas (..and yes, even without the downloading and going through the gas station app), and offers on Verizon. Unfortunately, I haven’t seen Apple. Ohhh….unlimited statement credits…now we’re talking!

LikeLiked by 1 person