Updated: 15 October 2020

In this hobby of points and miles, your credit score is vital. Each credit card company has rules that will determine your creditworthiness but your credit score will be the first piece of information that determines if the credit card company (or computer) deems you “qualified.”

Note: It can be devastating to be denied for a credit card, particularly, when you have great/excellent credit. Don’t become sad if you’re denied. Trust me…even individuals with excellent credit get denied.

Anyway, there are a lot of misconceptions about credit scores (and credit cards) so it’s important to understand how credit scores are calculated. Understanding this aspect will help increase your chances of being approved.

When I applied for my first credit card, I was denied because I “did not have credit.”

I tend to think in a step-by-step fashion so my natural response was “Am I missing something here!? How do I get credit if….you…don’t…give me…credit?”

Today, I have more than 15 active credit cards & I’ve learned a lot since then.

Did you just read that last line and say “wait a minute. Did he just say 15+ credit cards? Doesn’t that ruin your credit score?”

Nope. In fact, it actually improved my score but I talk about that in THIS BLOG.

Anyway, let’s start with my current credit score…

There are various apps where you can find your score but I, personally, prefer Credit Karma (CK) to check my credit score. It’s very user-friendly and it’s FREE! I also find that you have the same user-friendly experience on, both, their website and mobile app which can’t be said for other programs.

Once you create a profile and are logged in, CK will display your score that will range on a scale from 300-850 (as seen above). It will also display your score history over the last year and factors that are influencing your score.

How Is My Credit Score Calculated?

It’s good to know your credit score but it’s even better to know what influences that score.

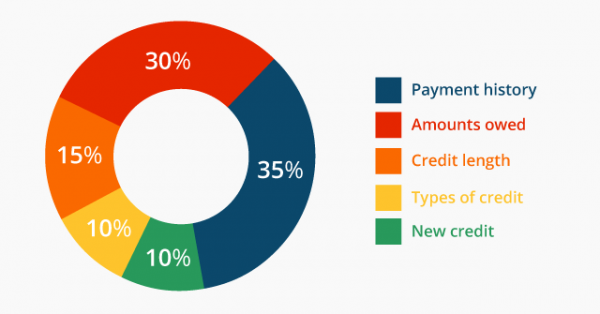

In short, this is how your credit score is calculated:

- 35% of your score is your payment history (MOST IMPORTANT)

- 30% of your score is credit utilization (VERY IMPORTANT)

- 15% of you score is credit history (SOMEWHAT IMPORTANT)

- 10% of your score are the types of credit you use (SOMEWHAT IMPORTANT)

- 10% of your score is your request for additional credit (LESS IMPORTANT)

Let’s focus on the largest percentages, because they will have the greatest affect on your credit score.

- 35% – Payment History: Do you make on-time payments?

- 30% – Credit Utilization: The bank has given you a credit line. What percentage of your credit line are you using?

- 15% – Credit History: Have you had credit for a long time?

Ideally, you want to make on-time payments and use less than 30% of your credit line. I have found that the third aspect, credit history, isn’t as significant as the first two.

But as you can see, those three aspects comprise 80% of your credit score. So if you can make on-time payments and not spend all your money, you’ll automatically improve your score. That’s HUGE!!!

The remaining 20% of your credit score is a combination of 1) the types of credit lines you use (e.g. mortgages, credit cards, etc.) and 2) your requests for new credit.

FINAL STAMP

The information described above is a building block. It should be the foundation for diving into this hobby.

Understanding what your score is and how it is calculated is important but even more important is your ability to be responsible. No amount of points are worth debt!

I cannot say this enough but if you are unable to pay your credit card in full EVERY MONTH, please do not get into this hobby. The fees and interest quickly cancel out any benefit that you would receive.

Note: This article is part of our Beginners Guide so…

One comment