Let’s get straight to the point…some of the links on this site pay 1TattedPassport a referral bonus for anyone that is approved. For our complete advertising policy and details about our partners, please click HERE. Although using the links are completely optional, we are eternally grateful when you do.

I enjoy telling everyone (who will listen) about the amazing value they can achieve by maximizing credit cards and using them responsibly. The amount of points that you can receive from one sign-up bonus can, typically, be enough points to put you in a comfortable lie-flat seat in the front of the plane. That’s incredible!

There are so many great credit cards out there that I find it difficult to keep track. However, when I’m talking to a skeptic about credit cards, there’s one misconception I hear more than any other and it usually sounds like this: “…but I heard that applying for credit cards is bad for your credit score.”

IS THERE ANY TRUTH TO THIS NOTION?

Although my score recently went down, I have quite a few credit cards and my score remains “excellent.” How is this possible? Let’s take a look…

You may remember THIS BLOG where I detailed how your credit score is determined.

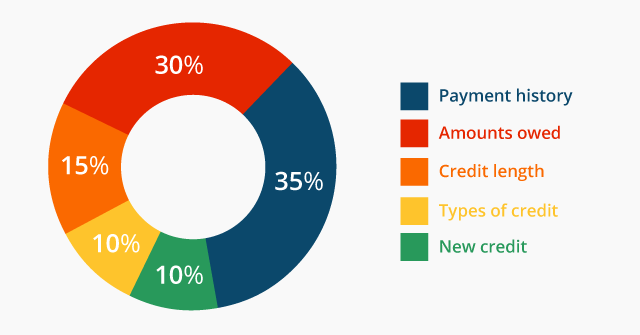

In short, your score is comprised of:

- 35% = payment history (the percentage of payments you’ve made on-time)

- 30% = credit utilization (the percentage of credit you’re using compared to your total limit you’ve been given by the bank)

- 15% = credit age (the average age of your open accounts)

- 10% = types of credit you use (how many different types of requests for credit you have)

- 10% = requests for new credit (how many times you’ve applied for credit)

I want to focus on credit utilization. This is where adding a new credit card to your credit file actually helps boost your credit scores in the long run.

As you can see, credit utilization makes up a significant amount of your credit score (30%) and is calculated by adding all your credit card balances at any given time and dividing that by your total credit limit.

THE GOOD SIDE (…WITH A REAL LIFE EXAMPLE)

Let’s say that you have one credit card with a $5,000 credit limit and you spend $5,000 on it total per month. You’re utilizing 100% of your credit ($5,000 / $5,000). <—Even if you can pay it off, DO NOT DO THIS!!! I’m telling you from real life experience!

Now, let’s say, you have 10 credit cards with a $5,000 credit line each (thus $50,000 of available credit), and you still spend $5,000 per month. Now, you’re only utilizing 10% of your credit ($5,000 / $50,000).

Your utilization ratio has decreased from 100% to 10%. Experts suggest keeping your utilization ratio below 30% but, for the best scores, below 10%.

Utilizing 100% will have a HUGE negative impact on your credit score. Why? Card issuers put you in 3 categories…low-risk, medium risk, or high risk. They are, ultimately, worried if you’re going to pay them back. Utilizing 100% of your credit line puts you, solidly, in the “high risk” category and that is NOT where you want to be.

Meanwhile, if you have a lot of credit available to you but you’re not using it, card issuers view that as low risk, because they can see how responsible you are.

THE BAD SIDE (…IF THERE REALLY IS A BAD SIDE)

“…But My Score Went Down When I Applied For A Credit Card, Why?“

You’re right! When you apply for a new credit card, the credit card issuer will, typically, do a ‘hard pull’ on your credit. They want to determine if they should extend credit to you. <–This is why a good score is critical. Once they perform the ‘hard pull,’ the impact varies by person but each inquiry will, typically, “ding” your score about 2-5 points. Credit scores max out at 850, so a 2-5 point drop is basically nothing.

This is the only consistent downside to applying for credit cards.

The other downside (though it doesn’t have to be a downside) is that your average age of accounts (10% of your credit score) decreases. For example, let’s say you previously had just one credit card for 10 years, and you apply and are approved for a new card. Now your average account age will be five years (10 years / 2 cards). The way to prevent this from being a problem is to keep a few credit cards open for a long time.

A REAL LIFE EXAMPLE

Let’s take a look at my credit score…

… and the factors affecting my credit score…

As you can see here, on the “high impact areas,” I do fairly well — 100% of my payments are on-time, low credit utilization, and zero derogatory marks. My age of credit history could be better but I’ve applied for a lot of cards to test my theories for blogs. How can I write a blog about credit cards if I don’t complete “market research!?” 😉

I want to be completely open and honest…when I applied for my first credit card, my score was in the upper 500’s. I’m not quite sure how it got that low but regardless I worked at making it better. I don’t have a clear timeline on how fast you can improve your individual score because I spent a lot of time testing different theories. But my situation isn’t an isolated incident. Many of my family members agreed to assist me when I began testing my theories and every single person has improved their score with my assistance.

FINAL STAMP

Here’s a fact…EVERYONE spends money. Whether you spend $1 million total this month or $100 total this month, you should be rewarded for whatever expenses you have in the form of points or cash back.

It’s hurts my soul when I see individuals pay for items or services with a debit card. Those who are using debit cards or paying cash are basically throwing money out the window.

I think this blog provided a solid foundation to debunk the belief that applying for credit cards will hurt your credit score.

In the short term, yes you’ll be “dinged” a few points but in the long term the benefits (e.g. decreased credit utilization, positive payment history, more points to redeem for flights, etc.) far outweigh the few points lost.

I would encourage you to share this article with others because it is a critical building block for their future.

So who is inspired to put their debit card down and begin maximizing credit card points, while simultaneously improving your credit score?

So my credit score was 802 until I paid my car loan off. It dropped to about 772 then to 760. I had one credit card with a 10k limit and made a $1,000 purchase and it dropped my score to 742! OCUCH!!!! I’ve never had interest on my card since I’ve been cardholder, no other debt, leans ect. I’m so confused on why it dipped so low. I recently opened a IHG card last week after reading your blog. my score only dropped about 2 points according to transunion.

LikeLiked by 1 person

Calculating credit scores are tricky. For simplicity, having debt helps you but it’s counterintuitive to obtain debt just to make your score go up. Just know this..keep doing what you’re doing. TBH, there’s no real difference between a ~750 and 800 and attempting to have an 850 is pointless (unless you want to brag about it). In my experience, 700 appears to be the magic number. 700+ can get you almost any card on the market. Trust me, you’re good.

LikeLike